How VTB implemented

a 2TB cache for hot data

VTB is the second‑biggest bank in Russia in terms of assets and profitability. It serves more than 16 million individuals and more than 1 million legal entities and entrepreneurs. A mobile banking service, VTB Business Lite, has been created for the bank’s business clients.

Task and requirements

VTB Business Lite is a mobile banking service for legal entities and entrepreneurs. It allows you to manage salaries, exchange currency, open deposits, order certificates, and conduct other banking operations.

The mobile application was released in mid‑2020. It is built on monolithic backend technologies for remote banking. During operation, it became clear that such a solution was difficult to maintain, update, and adapt to growing loads — even then the application had about 100,000 users. A transition to a microservice architecture was required. It began in April 2021.

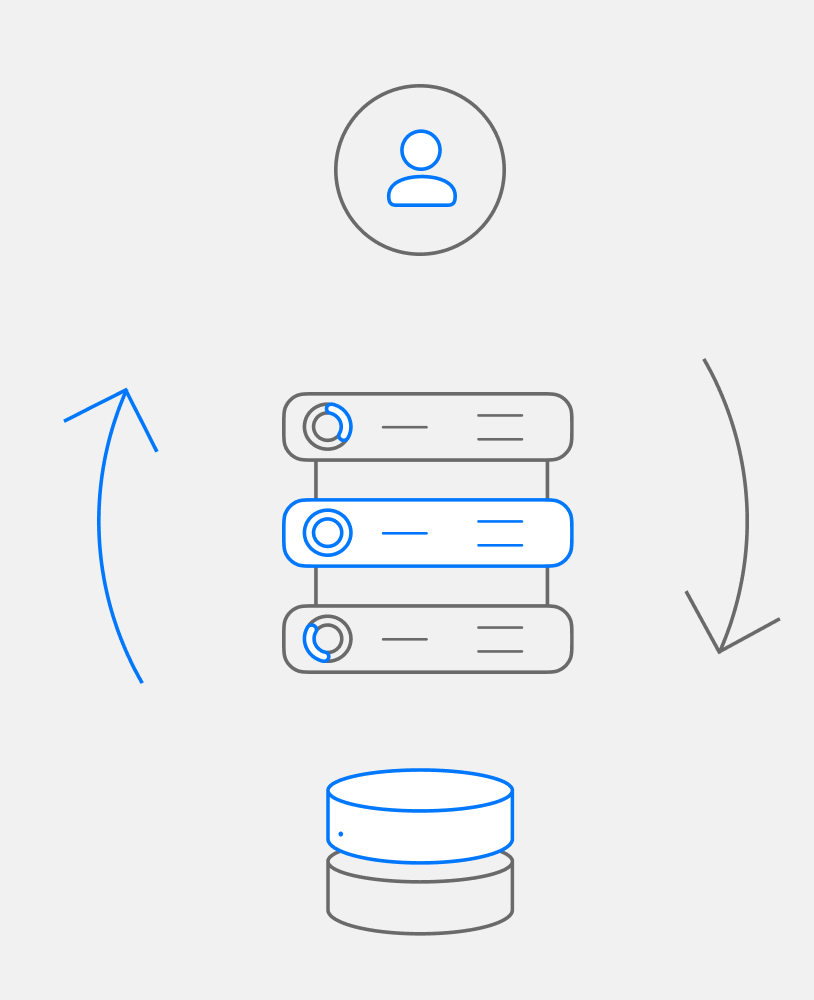

After the transition, systems storing user data about transactions, balance, connected products, linking a legal entity to a physical one became independent. Since client data were now being collected gradually, data exchange was taking a long time, and information in the mobile application was received with delays. The problem worsened as the number of the application users grew.

To solve this microservice architecture issue, it was vital to find a new solution that would allow:

- Reducing the delay in data exchange between the bank’s internal systems and the VTB Business Lite mobile application. Since user data was stored in different services with different SLAs for response time, the exchange could take up to several seconds, which created a high load on the infrastructure. As a result, it was taking too long for the information in the application to update.

- Improving system fault tolerance.

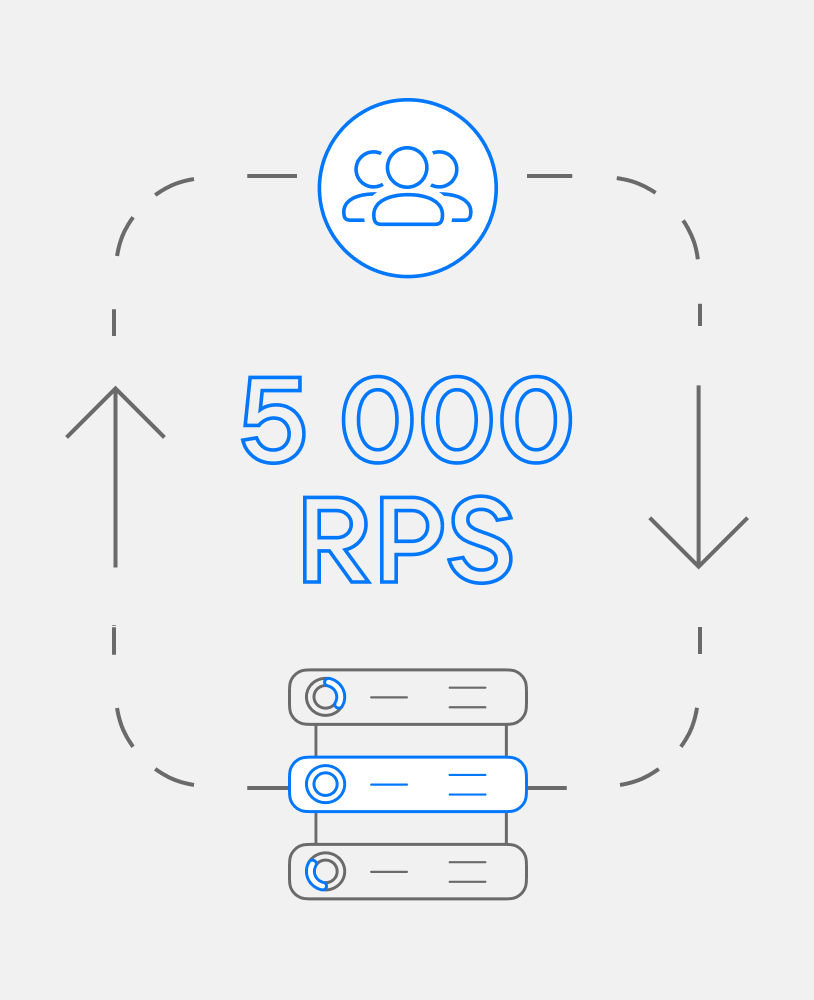

An increase in the number of users in the future could lead to problems with processing and accessing data. - Increasing request processing speed.

A too large number of requests to the main services could cause delays in their work, as well as problems with other users of the main services data.

Results

700 GB

The volume of the hot persistent cache of user data: legal entities, individuals, information about accounts, transactions, available client services and products, etc.

0.2–0.4 seconds

Response time with load reaching 15,000 RPS

Up to 2 TB

Can be stored in a scaled in‑memory Tarantool storage.

Still have questions?

Tell us about the tasks of your project,

and we will compose a solution for you on Tarantool

Get a consultation

Order a demo

Thank you for your request

Tarantool experts will

contact you shortly